The African music industry is experiencing a golden era, marked by explosive growth, increasing global influence, and a rapidly evolving digital ecosystem. Major global labels such as Universal Music Group (UMG), Warner Music Group (WMG), and Sony Music Entertainment (SME) are doubling down on their investments, establishing hubs, acquiring local catalogues, and forming strategic partnerships. This surge in activity underscores the continent’s potential as a critical growth market and its unique cultural value.

The African Music Industry by the Numbers

Current Market Size and Growth

According to recent estimates by PricewaterhouseCoopers (PwC), Africa’s music, radio, and podcasting market is projected to grow from $1.7 billion in 2022 to $2.2 billion by 2027, reflecting a compound annual growth rate (CAGR) of 5.6%. In Sub-Saharan Africa, streaming revenues alone grew by 24.5% in 2023, showcasing the region’s adoption of digital music platforms like Spotify, Apple Music, and Boomplay.

The IFPI’s Global Music Report 2023 revealed that Sub-Saharan Africa was the fastest-growing region for recorded music revenues for two consecutive years. This rapid growth is fuelled by increasing smartphone penetration, improved internet connectivity, and mobile money systems’ popularity, making digital music services more accessible.

Predictions for the Industry

- Global Reach: Goldman Sachs predicts that the global recorded music market will reach $53 billion by 2030, with Africa contributing significantly due to its growing music production and consumption.

- User Base: By 2030, Africa is expected to have over 600 million smartphone users, creating a massive audience for digital music platforms.

- Streaming Revenues: Analysts project that Africa’s streaming market could grow by 12%–15% annually over the next decade as more platforms localise their offerings.

Catalogue Valuation

The rise of Afrobeats, Amapiano, and other African genres has increased the valuation of African music catalogues. A hit catalogue from artists like Burna Boy, Wizkid, or Master KG could generate millions annually from streaming and sync deals, licensing, and global tours. As African artists dominate streaming charts, their catalogues are becoming prized assets for major labels.

Why Majors Are Eyeing African Music Catalogues

Evergreen Content in a Streaming-Driven Market

In today’s music economy, catalogues have become the backbone of revenue generation. Over 70% of music streamed globally is catalogue music (older than 18 months), making African music catalogues highly valuable. Labels are acquiring rights to capitalise on their long-term earning potential, driven by the sustained global interest in African music.

For example, Burna Boy’s African Giant and Wizkid’s Made in Lagos remain streaming powerhouses years after release, generating consistent income from platforms and sync licensing. Acquiring such catalogues ensures predictable revenue streams for labels.

Bridging the Cultural Gap for Sync and Licensing Deals

The global entertainment industry increasingly looks to Africa for authentic sounds, leading to a surge in sync deals in films, video games, and advertising. Netflix productions like Queen Sono and Blood & Water prominently feature African music, while brands like Nike and Coca-Cola use Afrobeats tracks in marketing campaigns. By owning African music catalogues, major labels position themselves as gatekeepers to this sought-after cultural treasure trove.

Strategic Investments by Major Labels

Universal Music Group

Universal Music Group (UMG) has been at the forefront of African acquisitions. Its key moves include launching Universal Music Africa in Côte d’Ivoire in 2018 to serve Francophone West Africa and Universal Music Nigeria in Lagos. These hubs focus on identifying, signing, and developing artists for the global market. UMG has signed high-profile deals with Afrobeats stars like Tiwa Savage, Tekno, and Yemi Alade, expanding its African repertoire.

In 2023, UMG partnered with Mavin Records, co-founded by Nigerian producer Don Jazzy, to distribute the work of rising stars such as Ayra Starr and Rema via Virgin Music. This partnership further cements UMG’s footprint in Africa’s creative and business sectors. Additionally, UMG is leveraging its expertise to enable local artists to navigate the complexities of the global music landscape while maximising Africa’s immense growth potential.

In October 2023, Billboard reported that Mavin Global, Nigeria’s music company founded by Don Jazzy, is seeking investments or sales. This news broke the internet, prompting many music executives and fans to air their thoughts on what this could mean to the Afrobeats’ global push and the African music industry in general.

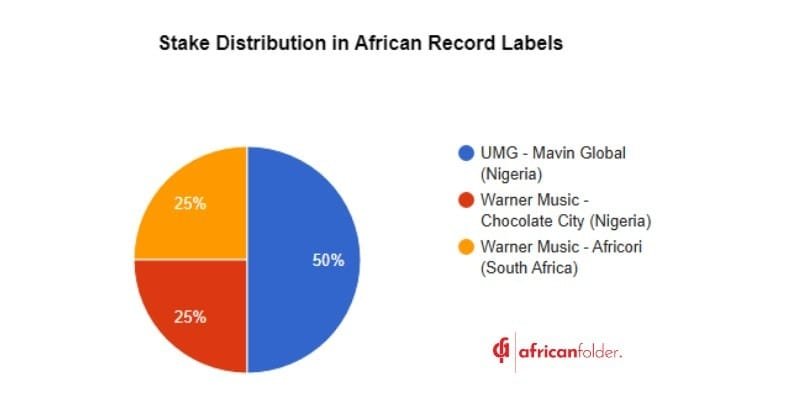

In February 2024, Universal Music Group announced a majority investment in the Lagos-based company, Mavin Global.

Warner Music Group

Warner Music Africa (WMA) has also made significant inroads into the African music scene. In 2024, WMA announced plans to establish a creative hub in Lagos, Nigeria, marking its first fully-owned office in the region. This move aligns with Warner’s commitment to developing Africa’s music infrastructure by enhancing A&R, marketing, and operations capabilities.

Warner Music Group’s prior acquisitions include a majority stake in Africori, Africa’s leading music distribution and rights management company that boasts offices in Johannesburg, Lagos, and London. Since its initial investment in Africori in 2020, Warner has accessed Africa’s largest catalogue and A&R network. This strategic foothold has enabled Warner to dominate emerging African markets, discover new talent, and distribute their music globally.

Additionally, Warner’s Social Justice Fund has contributed over $400,000 to Nigeria’s creative sector. Initiatives such as the Sarz Academy for music production and the West African Vocational Education program reflect Warner’s commitment to empowering local creatives and fostering sustainable growth.

Artists under Warner’s umbrella, like CKay and Joeboy, have gained global prominence, with CKay’s viral hit Love Nwantiti achieving multi-platinum certifications. The label’s new Francophone Africa venture, WM Africa Francophone (WMAFR), aims to deepen its presence in French-speaking Sub-Saharan Africa, creating cross-cultural collaborations and amplifying Francophone African talent.

Warner Music Group also has a partnership arrangement with music distribution company Ziiki Media and Diamond Platnumz’s record label WCB-Wasafi.

Sony Music Entertainment

Sony Music Entertainment (SME) has pursued a different but equally impactful strategy. In September 2024, SME and Crux Global announced a partnership to elevate Ghana’s music industry. Based in Accra, this collaboration spans three tiers: providing global distribution for emerging artists through The Orchard, offering full-service artist management under Sony Music Africa, and digitising and distributing Ghana’s rich musical heritage.

Crux Global, a leading Ghanaian-owned music company, is already celebrated for its success with the hit track Sugarcane (Remix) by Camidoh. By merging Crux’s local expertise with Sony’s global network, the partnership aims to give Ghanaian artists like Camidoh a platform to thrive internationally while developing the local industry through initiatives such as writing camps and educational summits.

The African Advantage

A Young, Digital-Savvy Population

Africa has the youngest population in the world, with a median age of 19.7 years, compared to the global average of 30.4 years. This demographic is not only music-hungry but also digitally connected, with a preference for streaming and mobile-first platforms.

Global Demand for Unique Sounds

Afrobeats, Amapiano, and African pop have become mainstays in global charts. Tracks like Burna Boy’s Last Last and Master KG’s Jerusalema resonate worldwide, making African sounds indispensable for global pop culture.

Untapped Markets and Regional Collaborations

With 54 countries and thousands of languages and cultures, Africa offers a vast array of untapped markets. Collaborations between African artists and global stars—such as Wizkid and Beyoncé on Brown Skin Girl—demonstrate the immense crossover potential of African music.

The Road Ahead

As the African music industry continues to flourish, the majors are poised to play an integral role in its growth. Their investments in catalogues, partnerships with local companies, and initiatives to develop talent underscore a long-term commitment to the continent.

Africa is no longer just a music scene to watch; it is a global powerhouse reshaping the industry. By acquiring catalogues and nurturing local talent, major labels are not only capitalising on the current wave but also laying the groundwork for sustained success in one of the world’s most dynamic music markets.