In the heart of Lagos, Nigeria, a sprawling 6,200-acre complex stands as a testament to one man’s audacious vision: the Dangote Refinery, the largest single-train oil refinery in the world. This monumental project, spearheaded by Aliko Dangote, Africa’s richest man, symbolises his relentless drive to transform Nigeria’s economy and cement his legacy as a titan of industry.

With a net worth of $27.8 billion as of March 2025, according to the Bloomberg Billionaires Index, Dangote’s journey from a small trading business to a continental powerhouse is a masterclass in entrepreneurship, resilience, and strategic innovation.

For Africans, entrepreneurs, and business people, Dangote’s story offers more than inspiration—it provides actionable lessons in leveraging local opportunities, navigating economic challenges, and building sustainable wealth. From founding Dangote Cement, Africa’s largest cement producer, to revolutionising Nigeria’s energy sector with the Dangote Refinery, his empire spans cement, sugar, oil, and beyond.

This article dives deep into how Aliko Dangote built his multibillion-dollar conglomerate, exploring his early life, business strategies, and the impact of his ventures.

Early Life: Roots of an Entrepreneurial Spirit

Family Influence and Upbringing

Born on April 10, 1957, in Kano, Nigeria, Aliko Dangote grew up in a wealthy Hausa family with a rich history of commerce. His great-grandfather, Alhassan Dantata, was West Africa’s richest man at the time of his death in 1955, trading kola nuts and groundnuts.

Dangote’s mother, Mariya Dantata, and father, Mohammed Dangote, were also successful businesspeople, but it was his grandfather, Sanusi Dantata, who raised him after his father’s death in 1965. This upbringing instilled a business mindset early on. At age eight, Dangote bought sweets with his pocket money, reselling them for a profit—a glimpse of the entrepreneurial flair that would define his career.

Education and First Steps

Dangote’s formal education at Al-Azhar University in Cairo, Egypt, where he studied business, sharpened his skills. Graduating in 1977 at age 21, he returned to Nigeria with a clear vision. Armed with a $3,000 loan from his uncle, he launched a trading business importing soft commodities like sugar, rice, and cement from Thailand and Brazil. His ability to repay the loan within three months showcased his knack for identifying high-demand markets and executing swiftly.

The Birth of the Dangote Group

From Trading to Manufacturing

In 1981, Dangote formalised his ventures by founding the Dangote Group, initially focusing on importing commodities like cement, sugar, and rice. Nigeria’s booming construction and consumer markets provided fertile ground, but Dangote saw a bigger opportunity: manufacturing.

In the late 1990s, as Nigeria transitioned from military rule to democracy, government policies began favouring local production. Dangote seized this shift, securing tax incentives to build factories for sugar, flour, and cement.

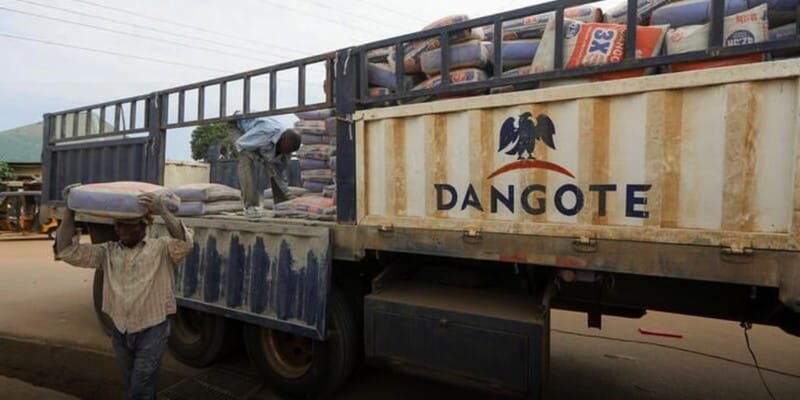

Dangote Cement: The Cornerstone of Wealth

The launch of Dangote Cement in 2000 marked a turning point. By acquiring the state-owned Benue Cement Company and commissioning the Obajana Cement Plant—now the largest in sub-Saharan Africa—Dangote transformed Nigeria from a cement importer to a producer. Today, Dangote Cement produces 48.6 million metric tons annually, operates in 10 African countries, and accounts for over 60% of Dangote’s wealth, with him owning an 86% stake. In 2023, the company generated $1.39 billion in revenue, despite a 14% price cut to counter economic challenges.

Strategies Behind Success

- Local Production: By producing cement locally, Dangote reduced Nigeria’s reliance on imports, saving foreign exchange and boosting self-sufficiency.

- Scale and Efficiency: Massive plants like Obajana allowed economies of scale, enabling competitive pricing despite high margins (over 60% most years).

- Political Acumen: Dangote cultivated relationships with Nigerian leaders, securing favourable policies and contracts, though critics label this as monopolistic.

Expanding the Empire: Sugar, Flour, and Beyond

Dangote Sugar Refinery

Launched in 2000, Dangote Sugar Refinery capitalised on Nigeria’s high sugar consumption. Its Lagos facility, producing 1.44 million tons annually, meets 90% of national demand, making it Africa’s largest sugar refinery. By 2007, sales reached $450 million, and the company was listed on the Nigerian Stock Exchange (NSE).

Diversification into Consumer Goods

Dangote’s ventures into flour, salt, and pasta followed a similar playbook: identify import-dependent markets, build local production, and dominate. His flour mill, started in 1999, tripled revenue to $270 million by 2008, while Dangote Salt and NASCON Allied Industries solidified his grip on consumer goods.

These businesses, listed on the NSE, contribute about one-third of the exchange’s market capitalisation.

The Dangote Refinery: A Game-Changer

Vision and Challenges

In 2013, Dangote embarked on his most ambitious project: a $20 billion oil refinery in Lekki, Nigeria, designed to process 650,000 barrels per day. Commissioned in May 2023 and operational by early 2024, the Dangote Refinery aims to end Nigeria’s reliance on imported fuel, saving up to $12 billion annually.

The project, funded largely by Dangote’s personal wealth and $5.5 billion in loans, faced delays, cost overruns, and scepticism. “I didn’t know what we were building was a monster,” Dangote admitted in 2024, reflecting on the intense pressure and media doubts.

Impact and Future Prospects

By January 2025, the refinery processed 500,000 barrels daily, producing diesel, aviation fuel, and gasoline. It meets Nigeria’s entire fuel demand (53 million litres of gasoline, 34 million litres of diesel daily) with surplus for export. Despite challenges like securing local crude and navigating currency devaluation, the refinery doubled Dangote’s net worth to $27.8 billion in 2024, reclaiming his title as Africa’s richest man after briefly losing it to Johann Rupert. Plans to list the refinery on the NSE and build a subsea gas pipeline signal further growth.

Key Takeaways

- Self-Sufficiency: The refinery addresses Nigeria’s paradox of being an oil-rich nation dependent on imported fuel.

- Economic Transformation: Analysts predict it could make Nigeria Africa’s largest exporter of refined petroleum products, boosting GDP.

- Resilience: Dangote’s ability to finance and complete the project despite setbacks underscores his determination.

READ MORE: Omolara Sanni: The Nigerian Entrepreneur Simplifying Nigeria-China Trade

Philanthropy and Social Impact

The Aliko Dangote Foundation

Established in 1994, the Aliko Dangote Foundation (ADF) is sub-Saharan Africa’s largest private foundation, with a $1.25 billion endowment. It focuses on health, education, and economic empowerment, addressing issues like childhood malnutrition, polio, and Ebola. Notable initiatives include:

- A $100 million partnership with the Bill & Melinda Gates Foundation to combat malnutrition.

- $2 million in humanitarian aid for the World Food Programme.

- Scholarships and infrastructure for Nigerian universities, like the Dangote Business School at Bayero University.

Balancing Wealth and Responsibility

Dangote’s philanthropy reflects his belief that wealth must drive social progress. “We Africans are the only ones that can make Africa great,” he told Forbes, emphasising his commitment to reinvesting in Nigeria rather than hoarding wealth abroad. His foundation aims to reach a $10 billion valuation, inspiring other African philanthropists.

Controversies and Criticisms

Allegations of Monopoly

Critics accuse Dangote of leveraging political connections to secure tax breaks and exclusive import licenses, creating near-monopolies in cement and sugar. A 2012 lawsuit against competitor Cletus Ibeto over alleged illegal tax breaks highlighted this tension. Some label him a “rentier” who benefits from government favours rather than pure entrepreneurship.

Panama Papers

In 2016, Dangote’s name appeared in the Panama Papers, linking him to four offshore shell companies. While no illegal activity was proven, the revelation sparked scrutiny of his financial transparency. Dangote maintains that his operations are legitimate and focused on Nigeria’s industrialisation.

Response to Critics

Dangote acknowledges detractors but emphasises his role in job creation and economic growth. “People throw a lot of mud at you, and you have to see how you can clean it up,” he told the Financial Times. His reinvestment of profits into Nigerian industries—unlike peers who store wealth abroad—bolsters his defence.

Lessons for Entrepreneurs

Actionable Insights

- Identify Local Gaps: Dangote targeted import-dependent sectors like cement and fuel, addressing national needs while building wealth.

- Reinvest Profits: Unlike many Nigerian billionaires, Dangote reinvests heavily in his businesses, fueling growth and resilience.

- Build Strategic Relationships: His ties with governments secured incentives, though entrepreneurs must balance ethics and influence.

- Think Big: The refinery’s scale reflects Dangote’s ambition to solve continental problems, not just personal gain.

- Persevere Through Setbacks: Cost overruns and delays tested Dangote, but his focus on long-term impact prevailed.

Inspiration for Africans

Dangote’s story resonates with African youth, proving that global success is possible despite systemic challenges. His emphasis on manufacturing over oil wealth challenges stereotypes about African economies, offering a blueprint for sustainable industrialization.

FAQ: Common Questions About Aliko Dangote

What is Aliko Dangote’s net worth in 2025?

As of March 2025, Aliko Dangote’s net worth is $27.8 billion per the Bloomberg Billionaires Index and $23.8 billion per Forbes, primarily from Dangote Cement and the Dangote Refinery.

How did Dangote build his wealth?

Dangote started with a $3,000 loan to trade commodities, later founding Dangote Cement, Dangote Sugar, and the Dangote Refinery. His focus on local production and reinvestment drove his empire’s growth.

What is the Dangote Refinery?

The Dangote Refinery, commissioned in 2023, is Africa’s largest oil refinery, processing 650,000 barrels daily. It aims to make Nigeria self-sufficient in fuel and enable exports.

Is Dangote involved in philanthropy?

Yes, through the Aliko Dangote Foundation, he supports health, education, and economic empowerment, with initiatives like malnutrition programs and university funding.

Why is Dangote controversial?

Critics allege he uses political connections for monopolistic advantages and tax breaks. His Panama Papers also raised transparency concerns, though he denies wrongdoing.

Conclusion

Aliko Dangote’s journey from a Kano trader to Africa’s richest man is a saga of vision, grit, and impact. Through Dangote Cement, Dangote Refinery, and his foundation, he has reshaped Nigeria’s economy and inspired a generation of entrepreneurs. His story teaches that wealth, when paired with purpose, can transform nations. For Africans and business people worldwide, Dangote’s empire is a call to dream big, reinvest locally, and persevere.

Want to learn more about African entrepreneurship? Explore AfricanFolder.com’s business section for insights on Dangote and other trailblazers.